ABC, Beacon, and SRS All Running Hard in Race to Dominate Roofing Supply

- Craig Webb

- Nov 7, 2023

- 2 min read

Updated: Nov 15, 2023

Editor's Note: The fourth paragraph of this story was changed on Nov. 15 to correct an error regarding how many roofing-oriented locations SRS has. It is 466 as of this writing, not 749 as previously reported.

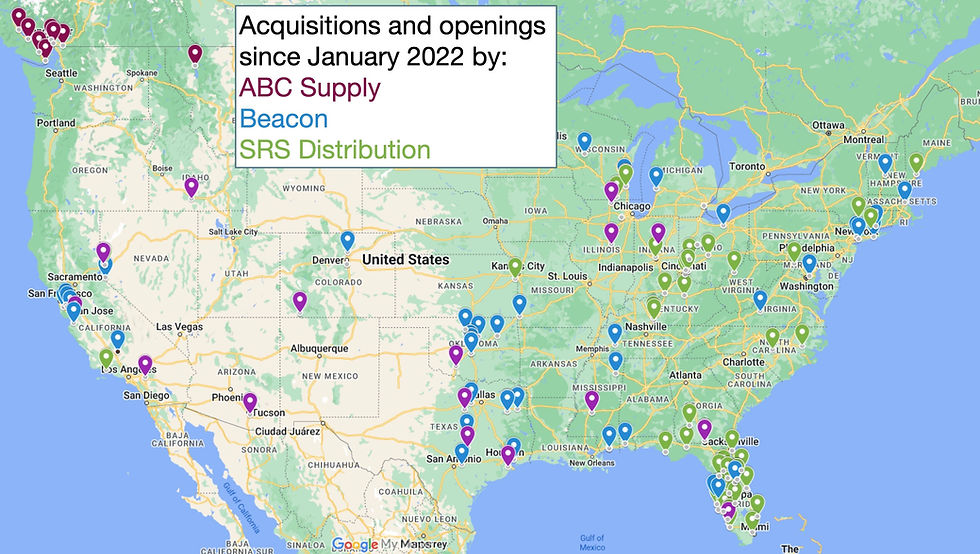

Combining acquisitions with greenfield openings, America's three biggest pro roofing suppliers are finishing the second year of their race to expand still nearly neck and neck.

Webb Analytics' deals register shows ABC Supply, Beacon, and SRS Distribution have acquired 117 locations and opened 112 new stores since January 2022. With one-tenth of this year to go, the three have bought 60 construction supply locations and announced 60 greenfield openings. That amounts to 15% of all deals and 30% of all greenfields this year.

The two-year count has Beacon with the most purchases and openings with 83, followed by ABC with 74 and SRS with 72.

While the most recent growth counts are nearly the same, ABC Supply still leads the field with 776 total facilities by Webb Analytics' count. Beacon is next with 550 roofing-oriented stores, while SRS has 466. Those overall counts, plus the two-year totals in the paragraph above, are just for roofing supply operations; they omit the current size and recent activities at ABC's drywall-centric L&W Supply, Beacon's Dealers Choice distribution division, and SRS's Heritage Landscape Supply and Heritage Pool Supply units.

The growth at Beacon is a core part of its Ambition 2025 to reach $9 billion in revenue by that year. Meanwhile, ABC Supply is getting bigger in part by having made its first expansions into Canada--it bought a roofing company in British Columbia this year and an Alberta-based operation last year. SRS' roofing purchases were relatively sparse in 2022, but it has burst back to life this year, making a splash with it acquisition of the 21 Sunniland stores, all in Florida, and the six-unit Marsh Building Supply chain in Ohio and Kentucky.

So far this year, there have been 396 construction supply facilities of all types purchased and another 197 opened. Those numbers fall short against full-year 2022's 483 facility acquisitions and 255 greenfield openings, but a true comparison won't be possible until we get through the usual end-of-year flurry of announcements.

Among the actions since mid-October:

The Building Center, a Charlotte powerhouse, acquired Contractors Building Supply, which has one store in Monroe, NC, near Charlotte and another on the coast at Ocean Isle Beach, NC.

84 Lumber opened a new yard in Stockton, CA.

Schockman Lumber Group acquired Iverson's Lumber, which has stores in Highland and Montrose, MI.

Burkes Do it Best Home Center of Fulton and Oswego, NY, came under new ownership when three locals bought the company.

McCoy's Building Supply plans to hold the grand opening of its new Lubbock, TX, store on Nov. 20.

Minnesota's Glenbrook Building Supply purchased Big Lake (MN) Lumber.

Outdoor Living Supply bought Apache Stone, which has branches in Phoenix and Apache Junction, AZ, as well as in Las Vegas.

Collins Supply of Wilmington, DE, closed.

Windows, Doors & More of the Pacific Northwest bought Island Sash & Door of Anacortes and Freeland, WA, as well as Eugene, OR.

W.E. Aubuchon bought Curry Ace Hardware, which has stores in Quincy and Hanover, MA.

Comments